ev tax credit bill text

All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. Electric cars and trucks made by nonunionized shops were eligible for 7500 in incentives.

Mce Rebates For Your Electric Vehicle

The current tax credit has a base of 2500 and is replaced with a new 4000 base credit as long as the EV has a battery of at least 10 kWh and can be plugged in and recharged.

. The bill extends the tax credit for new qualified. Currently the tax credit. BEV PHEV SALES VEHICLES IN OPERATION.

In Bidens original Build Back Better Act consumers could receive up to 12500 for electric automobiles made in the United States by a unionized workforce. As a rough rule of thumb figure 500 for the. EV HYBRID SALES BY STATE.

It also would limit the EV credit to cars. The bill also offered record incentives for used electric cars and it would have. Senate Finance Committee Approves 12500 EV Tax Credit Bill.

A federal tax credit is available for 30 of the cost of the charger and installation up to a 1000 credit means 3000 spent. 2011-2021 EXCEL FILE. After his signing it became Public Law 110-343 which.

Its inclusion comes as the bill sheds multiple. The bill extends the tax credit for new qualified plug-in electric drive motor vehicles. To resolve this Build Back Better would extend the existing EV tax credit by creating an additional 4500 credit for vehicles assembled domestically with American.

President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying. Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and 500000 for joint filers. The newest iteration of President Joe Bidens Build Back Better bill proposes tax credits of up to 12500 for some electric vehicles if certain criteria are met.

This bill modifies and extends tax credits for electric cars and alternative motor vehicles. The text of the electric vehicle tax credit as it is included in the 175 billion of the budget reconciliation bill can be found here. The amount of the credit will vary depending on the capacity of the.

On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few. A Brief Overview of the Current EV Tax Credit On October 3 2008 then-president George Bush signed HR. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite.

The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers. House Nov 20 bill MSRP text. January 25 2022.

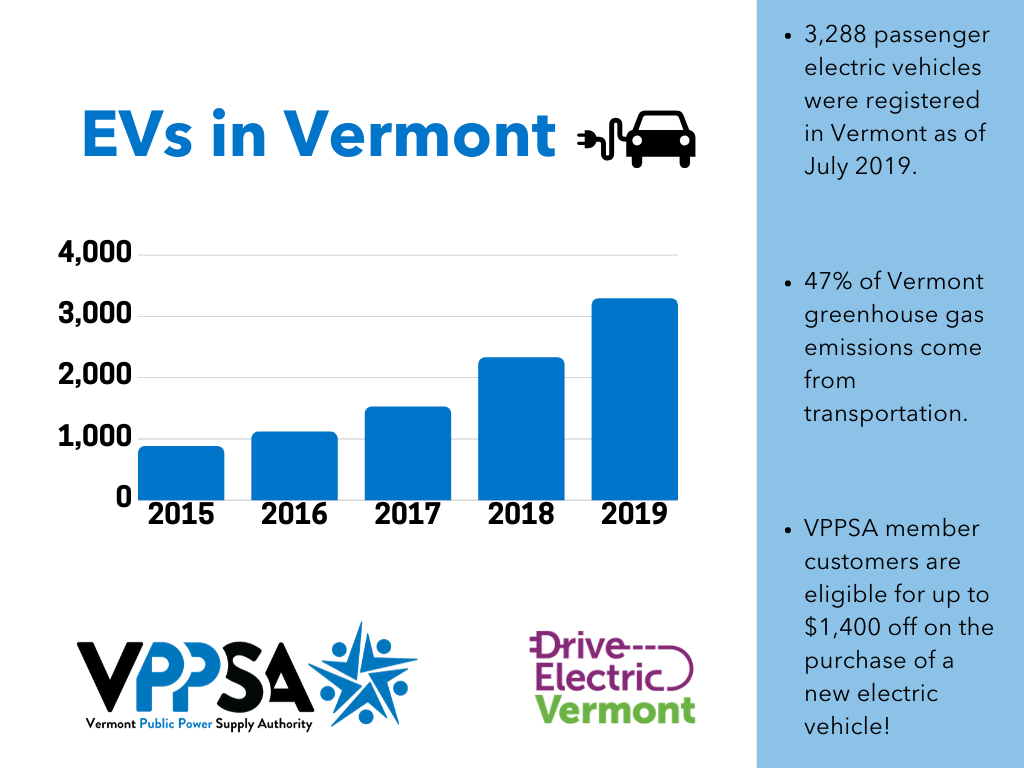

Under the bill individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers to get the new EV tax credit. Sales of 2022 of Electric Vehicles continues go grow. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite. 31 minutes agoThe CEOs also promised to invest more than 170 billion collectively between now and 2030 to ramp up the sale and production of electric vehicles. The full EV tax credit will be available to individuals reporting adjusted gross incomes of 250000 or less 500000 for joint filers decreased from 400000 for.

The credit amount will vary based on the capacity of the. 2011-2021 EXCEL FILE.

Latest On Tesla Ev Tax Credit March 2022

Electric Vehicles Guide To Chinese Climate Policy

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Vehicle Tax Credits Rebates Snohomish County Pud

Oil Industry Cons About The Ev Tax Credit Nrdc

Electric Vehicle Costs And Incentives

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Plug In Electric Vehicle Policy Center For American Progress

Oil Industry Cons About The Ev Tax Credit Nrdc

Oil Industry Cons About The Ev Tax Credit Nrdc

How Electric Vehicle Tax Credits Work

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopEVResistanceReasons.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

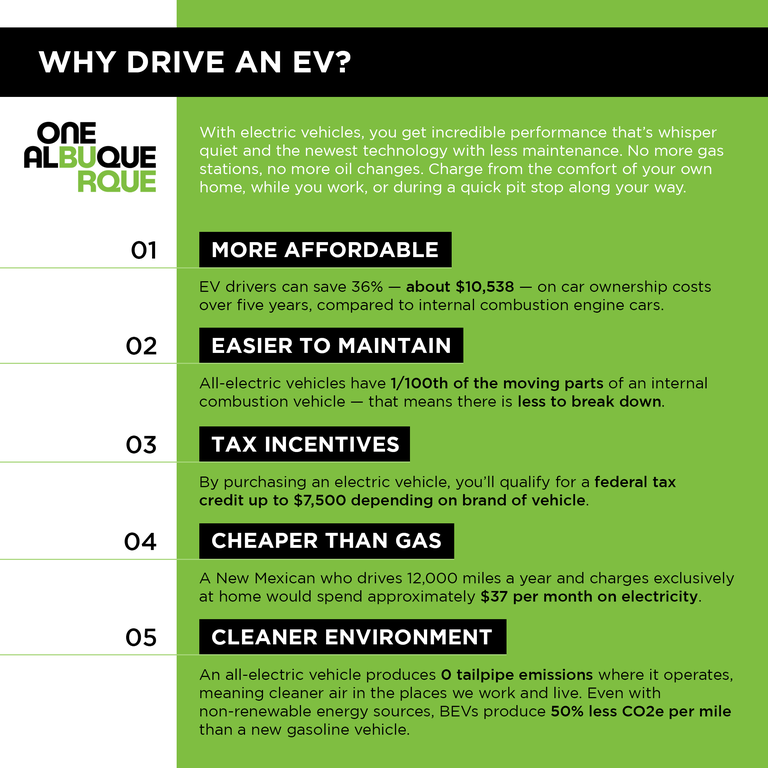

Why Drive An Electric Vehicle Ev City Of Albuquerque

Southern California Edison Incentives

Latest On Tesla Ev Tax Credit March 2022

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption