take home pay calculator maine

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major.

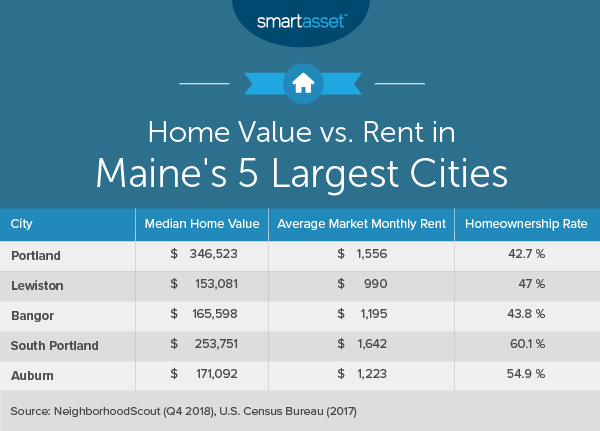

What Is The Cost Of Living In Maine Smartasset

Married filers no dependent with a combined annual income of.

. Mississippi doesnt have local income taxes. Simply enter your annual earning and hit Submit to see a full Salary after tax calculation. It can also be used to help fill steps 3 and 4 of a W-4 form.

Your income was calculated as hourly. This calculator is intended for use by US. Supports hourly salary income and multiple pay frequencies.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Filing 4000000 of earnings will result in 306000 being taxed for FICA purposes. About the US Salary Calculator 202223.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. PayCalc is updated every year and currently you can use pay rates to calculate net pay for previous 20202021 and current 20212022 financial years. If it was supposed to be weekly click the button below.

Calculating your Montana state income tax is similar to the steps we listed on our Federal paycheck calculator. CTC - tax - EPF contribution 10L - 78000 - 21600 Rs. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maine.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. This free easy to use payroll calculator will calculate your take home pay. Switch to Maine salary calculator.

Maine Hourly Paycheck Calculator. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers. Calculate your Maine net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maine paycheck calculator.

This results in roughly 7411 of your earnings being taxed in total although depending on. Details of the personal income tax rates used in the 2022 Maine State Calculator are published below the calculator this. Maine Salary Paycheck Calculator.

The federal minimum wage is 725 per hour while Maines state law sets the minimum wage rate at 1275 per hour in 2022. Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted. Jackson 1 and Tupelo 025.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s. The sales tax is 7 and only two cities add local sales tax. Calculating paychecks and need some help.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. View future changes in the minimum wage in your location by visiting Minimum Wage Values in Maine. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

An Independent Earner Tax Credit IETC of has been applied. Now that were done with federal taxes lets look at Maines state income taxes. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

How to calculate annual income. The tax rates range from 58 on the low end to 715 on the high end. Filing 4000000 of earnings will result in 131080 of your earnings being taxed as state tax calculation based on 2022 Maine State Tax Tables.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. This makes it easier for an employee to know the amount heshe would have at hisher disposal. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly and annual pay and tax rates.

If you dont qualify for this tax credit you can turn this off under the. Need help calculating paychecks. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

This reduces the amount of PAYE you pay. Our calculator has been specially developed in order to provide the users of the calculator with not only how. You are able to use our Maine State Tax Calculator to calculate your total tax costs in the tax year 202122.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable. The Viventium Paycheck Calculator is a free tool that will calculate your net or take-home pay. Finitys take-home salary calculator also provides the monthly take-home salary amount along with annual.

Maine Hourly Paycheck and Payroll Calculator. A single filer in Maine who earns 57000 per annual will take home 4461515 after taxes. Figure out your filing status.

Maine charges a progressive income tax broken down into three tax brackets. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maine. It also changes your tax code.

The net annual take-home salary as per new tax regime will therefore be. Federal and state taxes reduce a 100000 salary to take-home pay of 71691 in Mississippi. The share taken by the states income tax is an estimated 441.

The Maine Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Maine State Income Tax Rates and Thresholds in 2022. Maine does not have any local city taxes so all of your employees will pay only the state income tax. Maine Salary Paycheck and Payroll Calculator.

- Maine State Tax. This Maine hourly paycheck calculator is perfect for those who are paid on an hourly basis. Use this pay calculator to calculate your take home pay in Australia.

Take-home pay or wages are what is left over from your wages after withholdings for taxes and deductions for benefits have been taken out. Salaried employees can enter either their annual salary or earnings per pay period. Demands for a living wage that is fair to workers have resulted in numerous location-based changes to minimum wage levels.

Our Heating Cost Comparison Calculator Can Help You Estimate Your Annual Home Heating Costs For Differ Heating Systems Ductless Heat Pump Geothermal Heat Pumps

Drapery Measuring Guide With Calculator And Worksheet Custom Drapery Drapery Maine House

439 Summit St Maine House Real Estate Small House

Maine Income Tax Calculator Smartasset

Text Bsm To 36260 Mortgage Calculator Blue Stripes Apply Online

Maine Paycheck Calculator Smartasset

Maine Income Tax Calculator Smartasset

Grocery Store Located In Buxton Maine Employment Application Plummer Grocery

Maine Property Tax Calculator Smartasset

Jee Main Syllabus 2022 Paper 1 And 2 Pdf Download Syllabus Exam Wise

Browse Fonts In The Wanderlust Travel Brochure Font Pack Adobe Fonts Adobe Fonts Travel Brochure Wanderlust Travel Wanderlust

Maine Sales Tax Small Business Guide Truic

The Cost Of Living In Maine How Does It Stack Up Against The Average Salary

2020 S Best States To Retire Home Health Aide Retirement Smart Money

Maine Paycheck Calculator Smartasset

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Drapery Measuring Guide With Calculator And Worksheet How Long And Wide Should Your Curtains Be Custom Drapery Drapery Panel Siding

Craft Beer Maine Fun Fact Fun Fact Friday Craft Beer Fun Facts